MSCI (Morgan Stanley Capital International) is an American provider of equity, fixed income, hedge fund stock market indexes, and multi-asset portfolio analysis tools. MSCI ESG indexes rate all publicly listed enterprises included in MSCI indexes. As of June 2022, MSCI tracks data from over 14,800 issuers and 680,000 stocks or fixed income securities from an ESG perspective. Their ESG ratings cover 8,500 enterprises, with ESG ratings for over 2,900 enterprises publicly available, making it a global authority in ESG benchmarks.

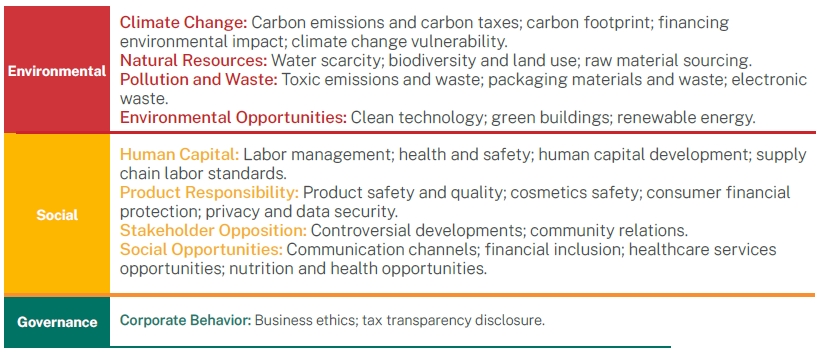

MSCI ESG ratings are based on three main pillars: Environmental, Social, and Governance, encompassing 10 themes and 35 key metrics. Enterprises are categorized into 11 sectors, 24 industry groups, 69 industries, and 158 sub-industries according to the Global Industry Classification Standard (GICS).

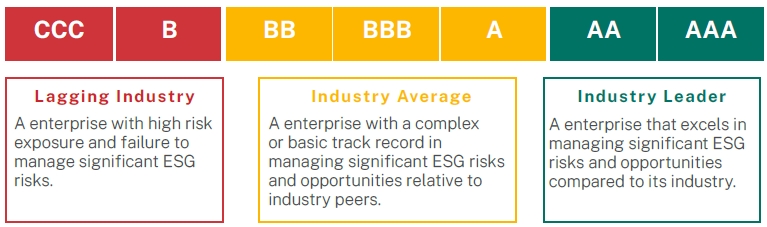

The purpose of MSCI ESG ratings is to measure a enterprise's resilience to long-term, financially relevant ESG risks. Enterprises are rated from highest to lowest as AAA, AA, A, BBB, BB, B, and CCC.

■ Enhanced Corporate Value and Reputation: High ESG ratings improve enterprise image and reputation.

■ Attracting Investors: Enterprises with strong ESG ratings are more attractive to investors.

■ Lower Financing Costs: Better ESG ratings can lead to lower costs of capital.

■ Promoting Long-Term Sustainable Development: Strong ESG performance supports sustainable business practices.

Murphy Fei + 86 13917452486

Aron Qu + 86 13917794381

Weber Hu + 86 18817921025

Email:cs@leveragelimited.com

■Shanghai : Leverage Limited (Shanghai) Co., Ltd.Address: Room 402, No 2. Building, No .1328, Hengnan Rd, Shanghai, China Phone: + 86 21 64067720 Email: cs@leveragelimited.com | ■ Hongkong : Leverage Global Limited Address: Room 1318-19, Hollywood Plaza, 610 Nathan Road, Mongkok, Kowloon, Hong Kong Phone: + 852 9045 0526 Email: info@leveragelimited.com |

【Contact Us】

Tel:

+86 21 64067720

Email: info@leveragelimited.com